Your complete guide to how we manage your investment portfolio

When you choose to invest your wealth with the help of your financial adviser, you might be wondering how the process actually works. Indeed, there are many ethical, financial, and personal factors to consider when investing your money with the help of a professional.

Read on to find out how we manage your investment portfolio here at Chancellor.

Your investment goals remain the number one priority

At Chancellor, ethics come first. We believe that your funds should be invested within a framework where there is no bias or incentive to the adviser personally, or our business as a whole.

So, we recommend our strategies based on what we believe will provide a positive outcome for our clients. The income we receive will be the same, regardless of our recommendations. In this way, our interests are aligned exactly with yours.

We work closely with Discretionary Fund Managers to create a strategy for growing your wealth

For some clients, we will recommend the services of a separate, independent investment manager, known as a discretionary fund manager (DFM). A DFM’s sole job is to implement the investment strategy we have agreed with you as part of your financial plan.

We have identified six different DFMs who we know from experience can provide additional value to our clients through their expert guidance.

Our criteria for selecting DFMs includes:

- Transparent and competitive charges

- Strong corporate governance and financial resources

- A repeatable and understandable investment process.

When presented with your portfolio, DFMs can focus their resources on selecting the investments they believe fit the risk profile provided by Chancellor.

In addition, DFMs have access to information above that available to the majority of independent financial advisers (IFAs). So, working with a DFM could give you further opportunities to grow your wealth over the years.

While there are rare occasions where we are paid by a DFM for our service with regard to client work (for our advice), it is important to note that Chancellor does not receive any remuneration or other incentives from any of these organisations.

We measure your portfolio’s growth based on a unique benchmark, using both in-house and industry-wide technology

Indeed, part of our role is to help you ensure that your portfolio generates your target returns over a period of years. We achieve this by monitoring each individual portfolio using a bespoke analysis tool that we have built within our business.

This analysis tool measures both the performance and the volatility your portfolio experiences against a client-specific benchmark, as well as against a peer group of other DFMs – not just the ones that we have within our current approved list, but also a wider, industry-based measurement.

The individual “benchmark”, meaning the measurement for your portfolio’s success, is set according to:

- Your attitude to risk

- Your long-term financial objectives

- Your capacity to accept losses and volatility.

It is important to note that a DFM will use their own benchmarks to validate their performance. However, having our own set benchmarks allows us to measure each portfolio with consistency.

In addition to our in-house measurements, we double-check that your portfolio is producing returns in line with overall expectations. To achieve this, we use an industry benchmark produced by Asset Risk Consultants (ARC). ARC compiles data from all major UK-based DFMs to allow a comparison for portfolios with a similar level of risk.

The benchmark applied to your specific portfolio is determined by the level of risk you tolerate.

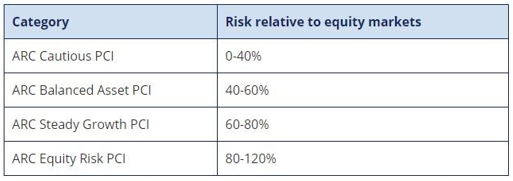

The table below shows the benchmark categories used by ARC:

As can be seen from the table, these categories are broad. In some circumstances, this can lead to a wide range of performance outcomes in the same category. So, we use the fine-tuning of our specific client benchmark in order to understand how your portfolio behaves, and the reasons for any deviation of returns.

Indeed, we have invested in our own analysis software that combines all your portfolio’s data together and produces an easy-to-understand output.

It is through this tool that we continually monitor your portfolio, and are able to identify trends of poor or positive performance, whether this is by your specific benchmark, or through those provided by DFMs.

You will receive regular updates on the performance of your portfolio

In order to keep you informed every step of the way, we formally review the performance of each DFM at the end of every month, and provide our clients with a quarterly report. During your annual review, you will see the performance of your portfolio against your individual benchmark, and the most relevant ARC PCI too.

It is our role to ensure the DFMs we work with are helping to yield a return that justifies their services on an ongoing basis. If your returns do not match our expectations, we will conduct a thorough analysis of your portfolio, and are in the best place to understand why the performance is not what we would expect.

We do not change DFMs lightly, as those that we have selected have historically performed in line with our high expectations. However, where a portfolio’s performance ultimately disappoints, we may recommend they move the funds to an alternative manager, in a very cost-effective and simple manner.

If recent market volatility has made you feel concerned, get in touch

We have had a challenging 2022 so far. It’s understandable that if your portfolio experiences poor performance in the short term, you may instinctively want to relieve yourself of the anxiety that comes with market downturns.

However, with a proper financial plan in place, volatility is part of the journey to reaching your ultimate objective. If your goals have not changed, then neither should your plan.

Get in touch

For more information on how we manage your investments in a time of economic volatility, contact us. Email info@chancellorfinancial.co.uk or call 01204 526 846 to speak to an adviser.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.